Investor Insight

Horizon Minerals’ near-term cash-flow potential and its significant land package in the prolific Western Australian goldfields with considerable exploration upside position the company to positively leverage the current bull gold market opportunity.

Overview

Horizon Minerals (ASX:HRZ) is an ASX-listed emerging mid-tier gold mining company focusing on a portfolio of highly promising gold projects located in the world-class Western Australian goldfields. The recent merger with Greenstone has added nearly 0.5 million ounces (Moz) of high-grade resource to Horizon, taking its total tally to 1.8 Moz, and will result in Horizon Minerals holding a land package of 939 sq km in the Kalgoorlie-Coolgardie district.

The merger brings near-term cash-generating opportunities and adds greater scale to its baseload assets (Boorara) with the high-grade Burbanks deposit. Horizon’s dual-track strategy involves generating immediate cash flows by leveraging a pipeline of development-ready production assets and concurrently advancing the cornerstone assets, Boorara and Burbanks, which have a combined resource inventory of 914 koz at 1.7 grams per ton (g/t) gold with potential to support a profitable, long-life operation.

The recent ore sale agreement with Paddington Gold is encouraging and increases confidence in the management’s ability to generate near-term cash flows. Under the agreement, 1.4 million (Mt) will be processed over a period of 22 months, commencing in September 2024 quarter. The agreement allows Horizon to capitalize on high gold prices to generate significant cash flows.

Horizon is also progressing with other projects, including the Cannon gold project and Penny’s Find underground mine, and actively exploring for new discoveries in the Western Australian Goldfields, targeting gold and other commodities such as nickel-cobalt, silver-zinc, PGEs and lithium across its extensive land holdings. Additionally, Horizon holds a significant stake in one of the world’s largest vanadium projects via its investment in Richmond Vanadium Technology, which is listed on the ASX.

Company Highlights

Horizon Minerals is an emerging mid-tier gold producer with an extensive portfolio of highly promising gold projects located in the world-class Western Australian goldfields.

Horizon is also progressing with other projects, including the Cannon and Penny’s Find underground mines, and bringing the Boorara open pit into production.

Amidst the current record gold prices, Horizon seeks to capitalize on this opportunity by advancing its substantial resource endowment towards development, thereby generating cash flow.

Key Projects

Boorara Gold Project

The Boorara gold project is located 15 km east of Kalgoorlie-Boulder in the Western Australian goldfields. Over the past decade, a substantial amount of reverse circulation and diamond drilling has been carried out at Boorara. The project includes a JORC 2012 mineral resource estimate (MRE) by Optiro (now Snowden Optiro), which reported a total of 11.03 Mt grading at 1.26 g/t gold, amounting to 448,000 ounces.

The company views Boorara as a substantial baseload feed source that could be enhanced by lower tonnage, higher-grade feed to sustain a standalone milling facility. This is where the recent acquisition of Greenstone becomes important. Boorara can be supplemented by higher-grade feed from Greenstone’s Burbanks deposit to support an integrated operation.

Boorara is fully environmentally permitted and ready for development, which is expected to commence within 2024.

Burbanks Gold Project

The Burbanks gold project is situated 9 km southeast of Coolgardie, Western Australia. The project encompasses the Burbanks Mining Centre and more than 5 kilometers of the highly promising Burbanks Shear Zone, historically the most significant gold-producing structure within the Coolgardie Goldfield. Previous underground production at Burbanks has surpassed 420,000 oz to date.

Burbanks currently hosts a total resource of 6.1 Mt @ 2.4 g/t gold for 466 koz, including underground of 1.2 Mt @ 4.4 g/t gold for 168 koz. Burbanks is underexplored and remains open in all directions for future growth.

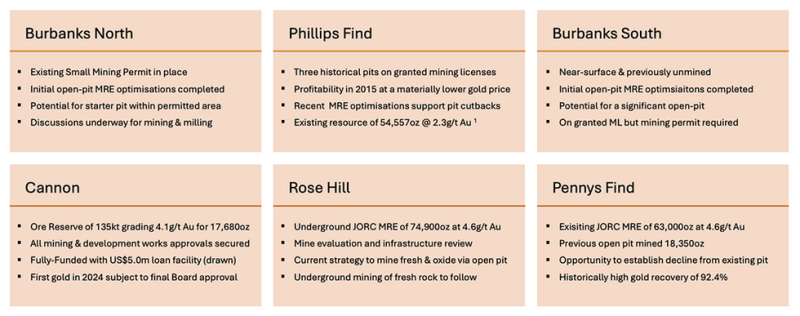

Cannon Underground Project

The Cannon gold project is located 30 km east-southeast of Kalgoorlie-Boulder. It is a fully permitted project with a pre-feasibility study completed in 2022, which shows strong project economics with a free cash flow of AU$10.1 million over the mine’s life. The company has finished commissioning a dewatering pipeline and a pumping system, representing a major milestone in the advancement of its Cannon Underground project. Discussions with mining contractors and potential JV mining partners are underway. First ore production from the Cannon Project is expected to commence in Q4 2024.

Penny’s Find

Penny’s Find is about 50 km northeast of Kalgoorlie in the Eastern Goldfields of Western Australia, near the company’s wholly-owned Kalpini gold project. It comprises a granted mining lease and other associated leases covering 91 hectares. The mineral resource estimate updated in December 2023 boasts 63,000 ounces of gold in the indicated and inferred category. A pre-feasibility study for exploitation using underground mining methods is currently underway. This study will include mine design and financial analysis.

Rose Hill

Rose Hill is 0.5 km southeast of Coolgardie and 35 km west of Kalgoorlie-Boulder, on the western edge of the Archean Norseman-Menzies Greenstone Belt. The current JORC 2012 resource at Rose Hill contains 93,300 oz , comprising an open-pit mineral resource of 0.3 Mt grading 2.0 g/t gold for 18,400 oz, and an underground mineral resource of 0.5 Mt grading 4.6 g/t gold for 74,900 oz. Nearly 70 percent of the resource is in the measured and indicated JORC categories.

Kalgoorlie Regional

Horizon owns several promising tenements within the Kalgoorlie region. These project areas include the greater Boorara-Cannon project area, Lakewood, Binduli-Teal project area, Kalpini, Balagundi-Kanowna South and Black Flag.

Coolgardie Regional

Horizon manages several promising tenements within the Coolgardie region, including Rose Hill, Brilliant North and Yarmany.

Management Team

Ashok Parekh – Non-executive Chairman

Ashok Parekh has over 33 years of experience advising mining companies and service providers in the mining industry. He has spent many years negotiating mining deals with publicly listed companies and prospectors, leading to new IPOs and the initiation of new gold mining operations. Additionally, he has been involved in managing gold mining and milling companies in the Kalgoorlie region, where he has served as managing director for some of these firms. Parekh is well-known in the West Australian mining industry and has a highly successful background in owning numerous businesses in the Goldfields. He was the executive chairman of ASX-listed A1 Consolidated Gold (ASX:AYC) from 2011 to 2014. He is a chartered accountant.

Jon Price – Non-Executive Director

Jon Price boasts over three decades of experience in the mining sector having served in Australia and abroad. During his roles, he has covered every facet of the industry, including exploration, development, construction, and mining operations. He has held roles in various gold and advanced mineral operations, notably serving as the general manager of the Paddington gold and St Ives gold operations in the Western Australian goldfields. He is a metallurgist and also holds a Masters in Mineral Economics from the Western Australian School of Mines.

Chris Hansen – Non-executive Director

Chris Hansen is a multidisciplinary metals and mining professional, combining core technical fundamentals with a strong finance and project development mind-set. Having initially focused on building a solid technical foundation with industry majors such as Fortescue Metals Group and Barrick Gold, Hansen later joined a pre-eminent London-based mining private equity fund developing robust investment skills, project development expertise, market knowledge and strong industry relations. Since returning to Australia, Hansen has leveraged his experience in both public and private markets, most recently having led mining business development activities for one of Australia’s largest private investment groups. He holds a BSc in geology from the University of Auckland, and an MSc in Mineral Economics from Curtin University.

Grant Haywood – Managing Director and Chief Executive Officer

Grant Haywood brings over three decades of experience in both underground and open-cut mining operations. During his career, he has served in senior leadership capacities in various mining companies, guiding them from feasibility through to development and operations. His experience spans various roles within junior and multinational gold mining companies, predominantly in the Western Australian goldfields, including positions at Phoenix Gold, Saracen Mineral Holdings, and Gold Fields. He is a graduate of the Western Australian School of Mines (WASM) and has also earned a Masters in Mineral Economics from the same institution.

Julian Tambyrajah – Chief Financial Officer & Company Secretary

Julian Tambyrajah is an accomplished global mining finance executive with more than 25 years of industry expertise. He is a certified public accountant and chartered company secretary. He has served as CFO of several listed companies including Central Petroleum (CTP), Crescent Gold (CRE), Rusina Mining NL, DRDGold, and Dome Resources NL. He has extensive experience in capital raising, some of which includes raising US$49 million for BMC UK, AU$122 million for Crescent Gold and AU$105 million for Central Petroleum.

Glenn Poole – Chief Geologist

Glenn Poole is a geologist with 15 years’ experience in exploration and production environments, having principally worked within orogenic gold systems for several major mining companies in Western Australia. Poole brings extensive experience in structurally controlled narrow vein gold and sulphide-associated gold deposits. He has previously held senior management roles with major Australian gold producer, Northern Star, during which time, he played a pivotal role in the identification and definition of new ore resources and mining fronts at both the Paulsens and Kundana operations. Most recently, Poole was the senior geologist at Firefly Resources (ASX:FFR), principally responsible for setting exploration strategy and leading the definition of the maiden JORC 2012 resource at Yalgoo. Poole holds a Bachelor of Science Geology & Geography from The University of Otago, and a Master of Business Administration from La Trobe University.