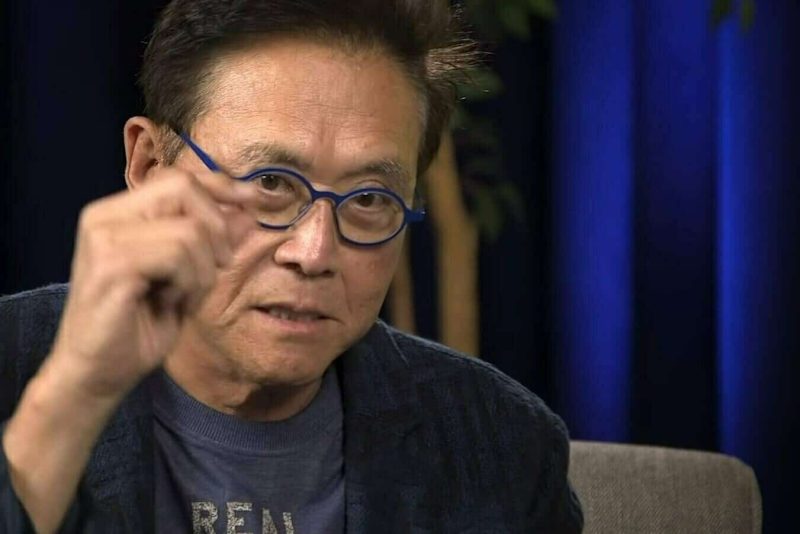

Robert Kiyosaki – author of the famous personal finance book Rich Dad Poor Dad – has come out with another statement in support of Bitcoin (BTC) as a superior money and investment asset compared to traditional stocks.

“Bitcoin is protection against the theft of our wealth via our money,” read a post to X from the author on Wednesday, titled “Why I Own Bitcoin.”

“Fed Chairman Powell, Treasury Secretary Yellin, and Wall Street bankers steal our wealth via our money, specifically via inflation, taxation, & stock price manipulation,” he continued.

Why I own Bitcoin. Bitcoin is protection against the theft of our wealth via our money. Fed Chairman Powell, Treasury Secretary Yellin, and Wall Street bankers steal our wealth via our money, specifically via inflation, taxation, & stock price manipulation. That is why I save…

— Robert Kiyosaki (@theRealKiyosaki) January 31, 2024

Though neither Powell nor Yellen has expressed interest in banning Bitcoin, the former has deemed it a failed currency due to its lack of adoption as a medium of exchange.

Other central banks including those of Sweden and the European Union have also disregarded Bitcoin as money because of its price volatility.

The European Central Bank specifically has argued that Bitcoin is “rarely used for legal transactions,” (though blockchain data would suggest otherwise).

Nevertheless, the Bitcoin protocol is renowned for only allowing a maximum supply of 21 million coins, making it impossible to debase the currency through monetary expansion. This has turned it into an “inflation hedge” in the minds of many, with some proponents like BlackRock CEO Larry Fink labeling it as “digital gold.”

Bitcoin also protects against theft in the more explicit sense: if nobody knows your private key, no bank or government can seize or freeze your funds.

Such qualities appeal to an investor of Kiyosaki’s taste. Not only has he long railed against fiat currency debasement, but he has proudly advocated for investors to become rich by using debt to purchase more scarce assets, such as real estate.

“That is why I save and invest in Bitcoin, not stocks, bonds, and fake dollars,” Kiyosaki continued.

Bitcoin Versus Stocks: Michael Saylor

In a video presentation last month, Bitcoin billionaire Michael Saylor argued that Bitcoin is a superior long-term investment to the S&P500, with greater upside potential and lower long-term risk.

The investor argued that stocks have effectively tracked the monetary inflation rate over the past 20 years because of their relative scarcity compared to dollars. Meanwhile, Bitcoin is even more scarce than stocks.

“The typical stock portfolio is gonna get you that 7% return… and over the long term, I would expect that Bitcoin will return 14%,” he said.

The post Rich Dad Poor Dad Author Explains Why He Owns Bitcoin Over Stocks appeared first on Cryptonews.