Source: Immunefi

Get your daily, bite-sized digest of crypto and blockchain-related news – investigating the stories flying under the radar of today’s news.

__________

Security news

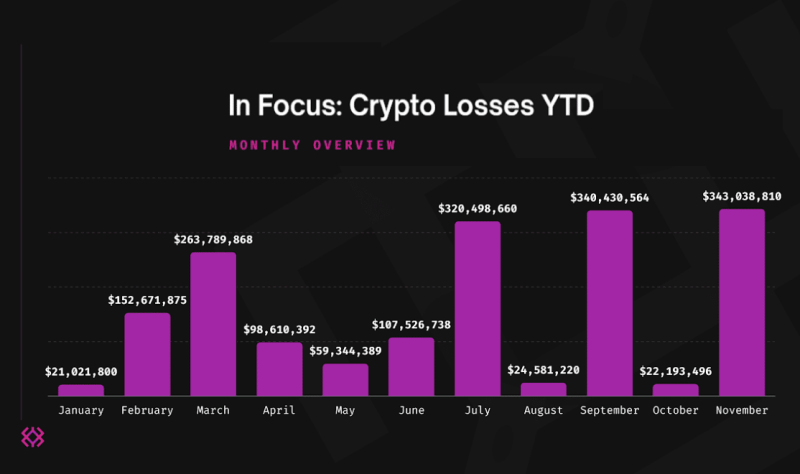

Major bug bounty and security services platform Immunefi found that $1,753,707,812 was lost to hacks and rug pulls in 2023 from January to November across 296 specific incidents. Per the company’s latest report, in November 2023 alone, $343,038,810 was lost to hacks and fraud – the highest monthly loss this year and a 15.4x increase from October when registered losses were $22,193,496. In November, $335,574,150 was lost to hacks across 18 incidents and $7,464,660 to fraud across 23 incidents. Compared to DeFi, in terms of funds lost, CeFi became the main target for exploits: it represents 53.8% of the total losses, while DeFi represents 46.2%. The increase was primarily led by the high-profile attacks on Poloniex, HTX Exchange, and Kronos Research. The most targeted chains were BNB Chain and Ethereum, representing more than half of the total losses across targeted chains at 83%. BNB Chain suffered the most individual attacks, with 22 incidents representing 53.7% of the total losses. Ethereum saw 12 incidents, representing 29.3%. Arbitrum followed with three incidents (7.3%), while Optimism, Avalanche, Fantom, and Heco Chain witnessed one incident each (2.4%).

Blockchain news

BNB Chain published its tech roadmap for opBNB. The roadmap targets 10,000 TPS (transactions per second) for transfers and a price reduction of ten times on opBNB. The opBNB fee reduction will start next week, reducing from $0.005 to $0.001. Between Q4 of 2023 and Q1 of 2024, opBNB will introduce multiple node types, increasing the capacity from 100M to 150M and implementing scalable data availability with lower costs, it said. The roadmap includes three key design principles: high performance and low cost; app chain architecture that can simplify the deployment of multiple application-specific Layer 2 solutions and connect them seamlessly; and collaborative community, fostering an engaged community that actively contributes to the development, governance, and growth of the opBNB platform.

DeFi news

Econia, an on-chain order book designed for atomic execution and settlement, announced its launch on the Aptos Mainnet. This follows the platform’s successful testnet phase, which saw substantial engagement with over $7.6 billion in trading volume and 1,000 active users. Per the press release, integrating with Aptos’ advanced optimistic concurrency model, Econia offers a trading experience that combines the benefits of centralized and decentralized exchanges (DEXs) in a single platform. It enables unrestricted market registration, allowing for a wide range of trading pairs. Also, its front-end partners and market makers are initially concentrating on the APT-lzUSDC pair, employing the Stargate bridge to integrate USDC into the Aptos ecosystem. This bridge, developed on the LayerZero interoperability protocol, streamlines cross-chain asset exchanges, providing users with the benefits of minimal fees and swift transaction speeds, it said.

Regulation news

Digital asset brokerage Fasset FZE has been granted a Virtual Asset Service Provider (VASP) license from the Virtual Asset Regulatory Authority (VARA) in Dubai, UAE. According to the press release, the operational license is the final stage in VARA’s approval process, which authorizes the company to provide virtual asset Broker-Dealer services to both retail and institutional investors in and from Dubai, to a global customer base. Prior to the company’s establishment in 2019, Fasset’s founding team had worked at the UAE Prime Minister’s Office across regulation for emerging technologies and started the initial conversations for crypto regulation, it said. CEO Mohammad Raafi Hossain commented that the company’s “focus on enabling people across emerging markets to access to digital assets is bolstered with this permission from VARA. As one of the most progressive regulatory frameworks in the world, the VARA approval is a crucial link in our global licensing portfolio, connecting places like Indonesia, Malaysia, Bangladesh, Pakistan and Turkey.”

The Financial Industry Regulatory Authority (FINRA), a US self-regulatory body for brokerage services, published a key topics page on crypto assets. The page offers an overview of FINRA’s crypto asset-related work, it said. It will include a blog on the Crypto Hub, current developments, and a variety of content on FINRA’s activities in the space. Visitors will also be able to find notices, guidance, news releases, and investor education articles on cryptocurrencies, the blockchain, and the basics of bitcoin, among other things.

The post Today in Crypto: $343,038,810 was Lost to Hacks and Fraud in November, a 15x Increase from October appeared first on Cryptonews.