Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

The crypto market today comprises hundreds of centralized exchanges, decentralized exchanges, AMMs, aggregators, and blockchains. Across Layer1s, Layer2s, and even Layer3s, assets such as ETH, USDT, and tokenized BTC can be traded. While this wealth of choice is to be welcomed, the balkanization of crypto trading does bring one major drawback: liquidity fragmentation.

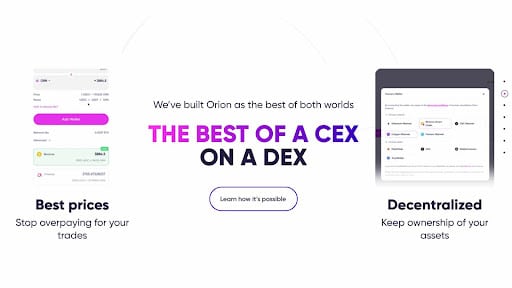

Scattered liquidity provides endless places and ways to trade, but it also means there is finite liquidity to absorb orders. This results in price discrepancies, slippage, and ultimately less money in the trader’s wallet. The cumulative effects of executing hundreds of trades a year on illiquid or suboptimal CEXes and DEXes quickly add up, resulting in thousands of dollars in lost profit – or tens of thousands in the case of whales. Orion is an all-in-one aggregator & trading terminal that was designed to fix this problem.

The post Orion’s All-in-One Trading Terminal Aggregates Crypto Liquidity appeared first on Cryptonews.